CSL Ventures: Partner to Early-Stage Energy and Industrial Technology Startups

The Energy and Industrial sectors are entering an era where digital technological innovation has become essential to facilitate cost reduction, efficiency improvement and meet new ESG goals. In this article, CSL Ventures highlights how there is a growing need to provide long-term sustainable capital, operational knowledge and guidance to emerging Energy and Industrial venture technology companies.

CSL Ventures was launched in August 2019 with the objective to enable leading entrepreneurs build successful enterprises by providing capital, deep industry connections and technology development and operational expertise.

CSL Ventures was launched in August 2019 with the objective to enable leading entrepreneurs build successful enterprises by providing capital, deep industry connections and technology development and operational expertise.

About Us

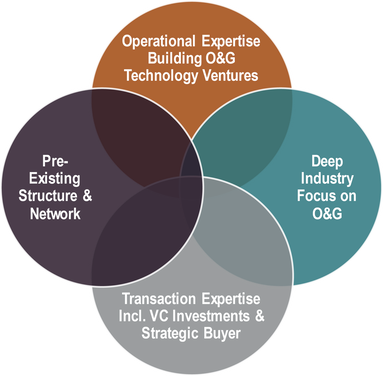

The energy industry is entering an era where technological innovation has become essential to facilitate cost reduction, efficiency improvement, and meet new environmental and social goals. In this environment, there is a growing need to provide long-term sustainable capital, operational knowledge and guidance to emerging energy technology companies.

CSL Ventures was launched with the objective of addressing the rapidly evolving technical needs of the energy industry and becoming the partner of choice for leading entrepreneurs and executives whether pursuing first capital for a start-up or later stage business development.

CSL Ventures was launched with the objective of addressing the rapidly evolving technical needs of the energy industry and becoming the partner of choice for leading entrepreneurs and executives whether pursuing first capital for a start-up or later stage business development.

|

DEAL SOURCING: Leveraging CSL’s extensive partners’ network to tap into opportunities from all over the world

ACCESS TO CSL'S PORTFOLIO COMPANIES: Testing technologies and facilitating trials with CSL’s portfolio companies STRONG RELATIONSHIPS: Close ties with the energy investment community and several E&P companies (super-majors, IOCs, NOCs, mid and small-sized operators) OPERATIONALLY FOCUSED AND FINANCIALLY DRIVEN: Investment team’s extensive digital, operations and finance experience SUCCESSFUL TRACK RECORD OF BUILDING, SCALING AND EXITING DE NOVO COMPANIES: Incubated 18 de novos across the entire Oil and Gas value chain, providing CSL with experience with early stage ventures that is second-to-none vis-a-vis its peers |

INVESTMENT APPROACH

The CSL Ventures team is leveraging CSL’s deep domain expertise in OFS along with a network of potential customers and advisors. This collaboration allows us to focus on already proven technologies and helps produce a quicker ‘time-to-market’ than typical energy technology investments. We are interested in capital efficient sub-sectors that can be proven and deployed in a modular way without a large footprint of people, equipment and inventory and the ability to avoid commoditized heavy iron segments in the following focus areas:

INVESTMENT CRITERIA

Industry Focus: CSL Ventures targets investments in innovative businesses creating technological advancements which can increase efficiency, reduce costs and meet rapidly changing environmental and social goals. We identify opportunities early and focus on Series A/B investments.

Investment Size: Our typical check size ranges from $500K-$5MM, although we are opportunistically flexible in our approach.

The CSL Ventures team is leveraging CSL’s deep domain expertise in OFS along with a network of potential customers and advisors. This collaboration allows us to focus on already proven technologies and helps produce a quicker ‘time-to-market’ than typical energy technology investments. We are interested in capital efficient sub-sectors that can be proven and deployed in a modular way without a large footprint of people, equipment and inventory and the ability to avoid commoditized heavy iron segments in the following focus areas:

- Software and Big Data

- IIoT (Industrial Internet of Things)

- Data Analytics

- Field Hardware Technologies

- Applied Material Science and Chemical Sciences

- Applied Grid Power and Energy Storage

INVESTMENT CRITERIA

Industry Focus: CSL Ventures targets investments in innovative businesses creating technological advancements which can increase efficiency, reduce costs and meet rapidly changing environmental and social goals. We identify opportunities early and focus on Series A/B investments.

Investment Size: Our typical check size ranges from $500K-$5MM, although we are opportunistically flexible in our approach.

- We collaborate with management teams to identify opportunities that may require a smaller check size but show a path for future growth.

- The expected holding period for our investments is 5 to 7 years.

Portfolio

|

DeepIQ is a provider of a software application called DataStudio (with a very simple drag and drop interface) that easily extracts and ingests large volumes of data (time series, geospatial, relational, structured etc.) from various IT and OT sources, moves it to the cloud, helps with data engineering / preparation / management and supports with detailed data analytics.

|

|

GoExpedi combines an e-commerce platform with an innovative supply chain model and is re-inventing rig servicing for the North American oilfields. It has created a fully on-line, rapid-delivery means of supplying critical parts to keep rigs up-and-running 24/7 and provides over 200,000 critical parts and supplies, with complete transparency on price, supplier choice, and availability through their online website.

|

|

Kiana Analytics, headquartered in Silicon Valley leverages existing infrastructure such as Wi-Fi, Bluetooth, Ultra-wideband, Security cameras to capture mobile and IoT device broadcasts to detect the presence of assets, visitors, and employees. Large volumes of real-time data are collected from each device to provide behavior analytics and insights, create the location and presence-based alerts, and dynamically manage asset, visitor, and workflows to enhance industrial safety, operational efficiency, and crisis recovery planning. Here is a short product demo video: https://www.youtube.com/watch?v=xGKEjz8v2PE

|

|

Machfu grew out of a simple idea that developing and maintaining applications in the industrial Internet of Things (IIoT) world should be as easy as it is in the desktop or the smartphone world. Machfu brings edge-to-enterprise connectivity to existing industrial infrastructure that can be deployed and scaled quickly. Rapid and highly secure application development increases productivity and improves operations as customers can easily build applications that integrate their existing technology and equipment with the cloud.

|

|

Mechademy’s Turbomechanica platform assesses the performance of assets at industrial facilities, with the goal of reducing downtime, increasing asset life, and optimizing maintenance. The platform integrates state-of-the-art deep learning and machine learning algorithms with proprietary physics-based performance models that allow plant personnel to gain deeper insights into the health of their assets. This integrated approach enables prediction of equipment failure months in advance, in addition to flagging sub-optimal operation and instrument failure.

|

|

MGB Oilfield Solutions is an engineering and manufacturing company providing surface equipment design, refurbishing and manufacturing services for more cost effective, more efficient and safer hydraulic fracturing operations. Company’s equipment technology, engineering, and refurbishment programs help to improve E&P operators & service providers margins by reducing frac-spreads’ CAPEX and OPEX, mitigating HSE risks while improving crew efficiency, and reducing the carbon emissions from the fracking operations with ergonomic designs and proven new technologies that improve the overall efficiency of the fracking operations.

|

|

RedList provides field service management software through a cloud-based mobile ready application to streamline workflows and optimize the performance of heavy equipment and crews. The features include real-time communication and reporting, location mapping, planning and dispatch, work order management, preventive maintenance scheduling, digital inspections, and route optimization. It also helps digital enablement of small-to-medium sized enterprises operating in the energy, industrial, and construction verticals.

|

|

Tourmaline Labs is an AI mobility company that enables enterprises to drive better business outcomes and more safely and efficiently manage their transportation workforce, vehicles, and networks of fleets. The AI-powered solution provides automated, self-managed programs with little to no human intervention, giving the kind of insights that the customers need in order to make better business decisions to reduce costs, improve safety and compliance, and run operations more efficiently.

|

|

WellWorth is a financial modeling and analysis SaaS platform for upstream finance teams. It has a mix of op / non-op / PE firms among its customers, who are using WellWorth alongside reserves applications like Aries / PHDWin / ComboCurve. They are able to import well-level reserves data from these tools and model corporate items like G&A, hedges, RBL / revolver, accruals, debt, equity, DrillCo / JVs / waterfall structures, distributions etc. This integrated workflow allows them to flex asset-level assumptions (type curves, field development plan, production risking etc.) and corporate-level assumptions, for outcomes such as financial statements analysis, hedging and risk management, roll-forward value-driven RBL estimation, cash flow management, capital structure optimization, and term sheets modeling.

|